top of page

AML Dashboard

Designing clarity inside regulatory complexity.

ROLE

Senior UX Designer

(Enterprise FinTech)

FOCUS

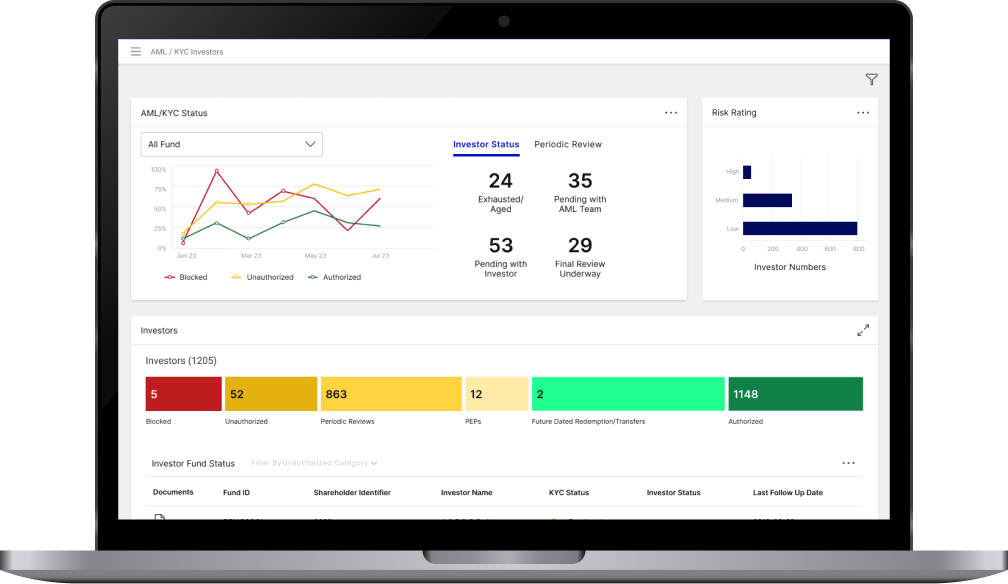

AML Dashboard

(Alternative Investments)

OUTCOME

Daster Decisions

(Clear compliance workflows)

Executive Snapshot

The Problem

Operational inefficiencies and unclear compliance signals slowed AML investigations, resulting in backlogs and analyst fatigue.

The Focus

Prioritising system performance, contextual access to data, and review transparency strictly within regulatory constraints.

The Impact

uccessfully improved decision clarity, significantly reduced manual effort, and built stronger client trust though transparent data handling.

Project Overview

Metadata Card

Organization: State Street

Domain: Enterprise FinTech (AML/KYC)

Role: Sr UX Designer

Duration: 4-6 Weeks

Methods: Thematic Analysis, Stakeholder Interviews.

Designing for Anti-Money Laundering (AML)

The AML Dashboard update project aims to enhance and operational efficieancy. While the dashboard performs basic tasks well and offers improved navigation and data flexibility, several areas require attention, including data loading speed, customization limitations, and linkage to KYC documents. This report outlines key strengths, improvement areas, and actionable recommendations.

The dashboard is used daily by compliance teams and client operations, where delays or ambiguity can directly impact regulatory outcomes and client trust.

Key UX Pain Points (Thematic Findings)

Recommendation Mapping

UX Execution

Status Monitor

KYC Status

Filter by Unauthorised Category

Dashboard

Summary Card

Investor Status

Periodic Review

Summary Card

Investor Status

Interaction

Outcome & Impact

Operational Impact

Reduced manual follow-ups and accelerated review cycles.

UX Impact

Lowered cognitive load by keeping data and documents in one view

Compliance Impact

Created clearer audit trails and enabled proactive communication.

Real impact is driven by clarity, not oversimplification. While we can't simplify regulations, we can simplify the interaction. This project succeeded because we honored the complex compliance requirements but stripped away the ambiguity and mental effort for the user.

bottom of page